The global e-commerce landscape is changing fast, and Amazon sellers are feeling it more than most. New U.S. trade policies, especially those affecting imports from China, are driving major changes in costs, shipping, and how sellers run their businesses.

But rather than panicking and overreacting, understanding the tariff impact on your business as an Amazon seller and making smart decisions is essential to safeguarding your margins and business. This guide breaks down the new tariff rules, their impact on Amazon sellers, and what sellers can do to remain competitive in this new environment.

What Are the New Tariffs in 2025?

The U.S. government has implemented a multilayered tariff structure that affects the cost of imported goods sold on Amazon. These tariffs target imports from China most aggressively but also extend to many other countries.

1. Cumulative Tariff Layers on Chinese Imports

Chinese products now face a stacked set of tariffs, potentially raising total duties for some product categories to more than 200%. These include:

- Base Duty Rates: Standard tariffs based on the product’s HTS (Harmonized Tariff Schedule) code.

- Section 301 Tariffs: Originally initiated in 2018, these still apply and can range from 7.5% to 100%.

- IEEPA Tariff (March 2025): A 20% emergency tariff under the International Emergency Economic Powers Act.

- Reciprocal Tariff (April 2025): A sweeping 125% reciprocal tariff on all Chinese imports, except smartphones, computers, and other electronics (these goods are subject to a 20% tariff).

Each layer is cumulative, meaning the total import duty for a product can compound significantly.

2. De Minimis Elimination for China

Previously, the de minimis exemption allowed sellers to import goods valued under $800 without paying tariffs. As of May 2, 2025, this exemption no longer applies to China and Hong Kong. Key updates include:

- A flat $100 fee per item or a 120% ad valorem tariff, whichever is higher, on low-value parcels from China.

- This will increase to $ 150-$200 per item starting June 1, 2025.

- Non-Chinese imports still qualify for the $800 exemption, making them more cost-effective.

These changes have sent a clear message: sourcing from China will now come at a high cost.

Tariff Expansion Beyond China

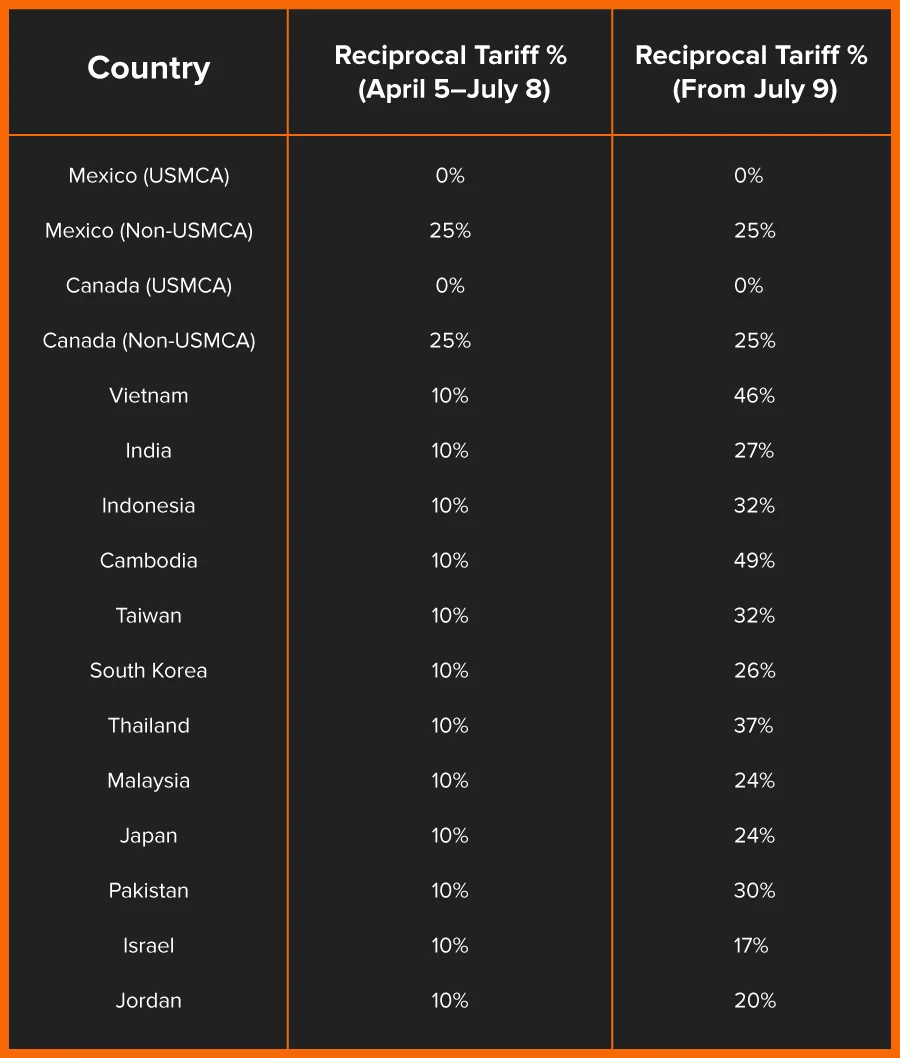

Although China is the primary target, other countries have not been spared. Effective from April 5, 2025, the U.S. has introduced a 10% baseline tariff on imports from all other trading partners.

Apart from the 10% blanket tariff on all trade partners, there are higher tariffs of 13-50% for 66 countries listed in Annex 1. Although the higher tariff rates are paused for 90 days until July 9, 2025, the 10% rate applies.

Tariff Rules for Mexico and Canada

Under the USMCA trade agreement, products imported from Mexico and Canada can enter the U.S. tariff-free, if they meet specific rules of origin and include the correct documentation.

However, if a product doesn’t qualify under USMCA, such as items with major non-North American components or missing certification, a 25% reciprocal tariff kicks in.

For the complete list, see Annex 1.

How the Tariffs Affect Amazon Sellers

Let’s dive deeper into the specific ways the tariffs affect Amazon sellers. These multi-dimensional impacts affect your cost structure, operations, and customer experience.

1. Higher Import Costs and Shrinking Margins

The most immediate effect of these tariffs is the increase in the cost of goods sold (COGS). This translates directly to tighter profit margins or uncompetitive product pricing.

- A product that once cost $5 to land in the U.S. might now cost $10 or more due to cumulative duties.

- Sellers who continue to source from China must now decide whether to absorb these costs or pass them on to the consumer.

This is a key reason Amazon prices are increasing across many product categories, especially for those that are predominantly made in China.

2. Supply Chain Disruptions

The complexity of the new rules has introduced additional delays and bottlenecks in the supply chain:

- Customs Clearance Times: Higher inspection rates and document checks lead to slower port processing.

- Sourcing Instability: Chinese suppliers may not be prepared for new compliance requirements.

- Freight Volatility: Tariff uncertainty has raised ocean and air freight prices as sellers rush to find alternatives.

Sellers must now plan well in advance and build in buffer time and budget for unforeseen disruptions.

3. Price Instability on Amazon

With import costs on the rise, many sellers are forced to raise their product prices. However, this presents a challenge:

- Buy Box Competition: If your competitors source from a lower-tariff region, you may lose the Buy Box despite offering a higher-quality product.

- Customer Pushback: Regular buyers may balk at new prices, especially if you don’t clearly communicate the value of your product.

- Search Ranking Risks: Lower conversion rates from higher prices can push your listings down in Amazon’s algorithm.

As a result, Amazon prices are changing more frequently than before, especially among third-party sellers affected by tariffs.

4. Compliance and Administrative Complexity

Dealing with tariffs as an Amazon seller now requires navigating a maze of new documentation and legal requirements:

- HTS Code Accuracy: Misclassification can lead to overpayment or shipment seizures.

- Country of Origin Rules: Even minimal Chinese components can trigger full tariffs.

- Paperwork Load: Customs forms, certificates of origin, and shipping declarations must now be airtight.

Hiring a trade compliance consultant or customs broker is fast becoming a necessity rather than a luxury.

How to Deal With Tariffs as an Amazon Seller

Faced with these challenges, what can Amazon sellers do? Here are actionable strategies:

1. Shift Your Sourcing Strategy: Think Beyond China

For many sellers, China has long been the go-to for manufacturing due to its scale, speed, and low costs. However, the latest Amazon tariffs have significantly altered the calculus. Sellers who continue relying solely on Chinese suppliers now face steep import duties, making even basic products unsustainable. It’s time to diversify your supply chain.

Action Steps:

- Explore New Markets: Countries like India, Indonesia, Turkey, and Thailand are ramping up their manufacturing capabilities. These markets offer lower tariff burdens and growing infrastructure for e-commerce exports.

- Run Cost-Benefit Analyses: Don’t just compare manufacturing costs, evaluate total landed costs (product + duties + freight + inspection + warehousing). A slightly higher factory cost in India may still be more profitable than a cheaper item from China with 200%+ tariffs.

- Pilot with Small Orders: When testing a new supplier or country, start small. Place sample orders, conduct quality inspections, and gradually increase volume once reliability is established.

By expanding your supplier base, you reduce risk, improve resilience, and gain negotiating power with manufacturers.

2. Use Data Analytics to Drive Smarter Decisions

Navigating a volatile pricing environment requires more than instinct, it demands real-time data and trend analysis. With Amazon prices increasing and margins tightening, sellers need to use analytics tools to understand how their products are performing and where to optimize.

Action Steps:

- Use Amazon Data Tools: Platforms like Jungle Scout, Helium 10, ZonGuru, and Keepa offer deep insights into product performance, competitor pricing, keyword trends, and Buy Box dynamics. Use them to track how your competitors are adjusting prices post-tariff and monitor profit margins after accounting for new import duties.

- Create a Tariff Impact Dashboard: Use spreadsheets or software to track your SKUs, their country of origin, applicable tariff rates, shipping costs, and final margins. Update this monthly to keep up with policy changes.

- Predict and Respond to Seasonality: Some tariff increases may hit hardest during seasonal surges (like Q4). Use historical data to prepare inventory and pricing strategies well in advance.

Data isn’t optional in dealing with tariffs as an Amazon seller, it’s the key to every smart decision.

3. Adjust and Future-Proof Your Business Model

Sellers who cling to the old way of doing business, relying on thin margins and cheap Chinese imports, will find it increasingly difficult to stay afloat. Instead, sellers should think about evolving their business models in ways that decrease tariff dependency and increase brand resilience.

Action Steps:

- Consider Domestic Product Lines: Selling U.S.-made products can help you avoid tariffs altogether. Consider working with American artisans, manufacturers, or wholesale distributors to build a domestic product line.

- Private Label Strategically: If you’re in private label, emphasize branding and perceived value. Invest in custom packaging, storytelling, and differentiation so you can justify higher prices without losing customers.

- Consider Wholesale or Bundling: Work with U.S. brands as a reseller, or create value-added bundles (e.g., combining multiple complementary items into a single SKU). Bundling can improve margins and reduce price sensitivity.

Adapting your business model gives you long-term flexibility and the ability to withstand global supply chain turbulence.

4. Strengthen Compliance and Operational Readiness

Increased scrutiny from customs authorities and Amazon’s compliance teams means that operational discipline is more important than ever. Dealing with tariffs as an Amazon seller isn’t just about cost, it’s about risk management, paperwork, and staying ahead of regulatory changes.

Action Steps:

- Work with a Customs Broker: If you’re not already doing so, hire a licensed customs broker who understands the latest U.S. tariff rules, including country-of-origin labeling, documentation, and classification codes (HTS codes).

- Review HTS Classifications: Incorrect classifications can result in overpayment or shipment delays. Ensure each of your SKUs has the most accurate HTS code to avoid red flags at customs.

- Audit Suppliers for Compliance: Ensure your factories are accurately declaring materials and origin. Products with even partial Chinese components may be subject to full tariffs.

- Maintain Paper Trails: Customs documentation (commercial invoices, packing lists, country-of-origin certificates) should be complete, consistent, and backed up. Amazon also requires accurate documentation for gated or sensitive categories.

By tightening your operational processes, you reduce shipment delays, avoid fines, and maintain seller account health.

5. Adjust Amazon Prices Gradually

If raising prices is unavoidable due to tariff hikes, avoid making sudden changes. A sharp increase can quickly lead to losing the Buy Box or triggering Amazon’s pricing alerts.

Action Steps:

- Increase prices gradually and aim for 10–15% at a time.

- Allow a few weeks between changes to let sales stabilize.

- This helps prevent sticker shock for customers and avoids pricing flags from Amazon’s algorithm.

To reduce disruption, some sellers raise the MSRP (Manufacturer’s Suggested Retail Price) first, followed by “Your Price” a week later. Others adjust both at the same time, but whichever method you choose, consistency across all channels is key.

While this approach helps maintain Amazon compliance, it may delay margin recovery, especially if tariffs push costs up sharply. In the meantime, finding cost-saving opportunities throughout your operations is crucial to protect profitability.

Conclusion

With new tariffs, especially on goods from China, the e-commerce game is shifting fast. But while these changes can feel overwhelming, they’re also a chance to get ahead.

Sellers who take time to plan, diversify their suppliers, and stay on top of the rules won’t just make it through, they’ll come out stronger. Success now depends on more than just having a great product. You also need to be informed, flexible, and ready to adjust when the market changes.

Don’t panic, plan. The sellers who win in 2025 will be the ones who think ahead and adapt with confidence.

Got More Questions?

To find out if an Amazon seller is located in China, you can check their public profile. Typically, the seller’s business address is listed within sections like “Business Information” or “Contact Seller.” If the address provided is in China, it indicates that the seller operates from there.

Tariffs increase the cost of imported goods, directly impacting profit margins for Amazon sellers. This often leads to difficult decisions about absorbing higher costs or raising prices, potentially affecting competitiveness and sales volume. Supply chain disruptions and increased logistical expenses can also arise.

Sellers can explore diversifying their suppliers to countries with lower tariffs and optimize their inventory management to reduce holding costs. Reviewing product classifications for lower tariff rates and negotiating costs with existing suppliers are also effective strategies to mitigate the financial impact.

Recalculating the complete landed cost, including tariffs, is essential for accurate pricing. Monitoring competitor pricing and potentially implementing dynamic pricing tools can help sellers adapt. Exploring tactics like offering product bundles or adjusting discount strategies may also be necessary to maintain profitability and sales.