Entering the world of e-commerce can be overwhelming, but Walmart Marketplace offers a straightforward and cost-effective way to reach millions of customers without the burden of hidden fees.

Whether you’re an established retailer or a new seller, understanding Walmart’s fee structure is crucial for optimizing your profits and scaling your business.

This comprehensive guide covers everything you need to know about Walmart seller fees, including referral charges, fulfillment costs, payment schedules, and tax considerations. By the end of this guide, you’ll have a clear understanding of how to navigate Walmart Marketplace with confidence.

Does Walmart Have Monthly Seller Fees?

Unlike many other e-commerce platforms, Walmart does not impose monthly subscription fees, listing fees, or item setup fees. Instead, sellers incur a commission fee that is calculated based on the product category. This fee-only model makes Walmart a cost-effective marketplace, aligning expenses directly with sales performance.

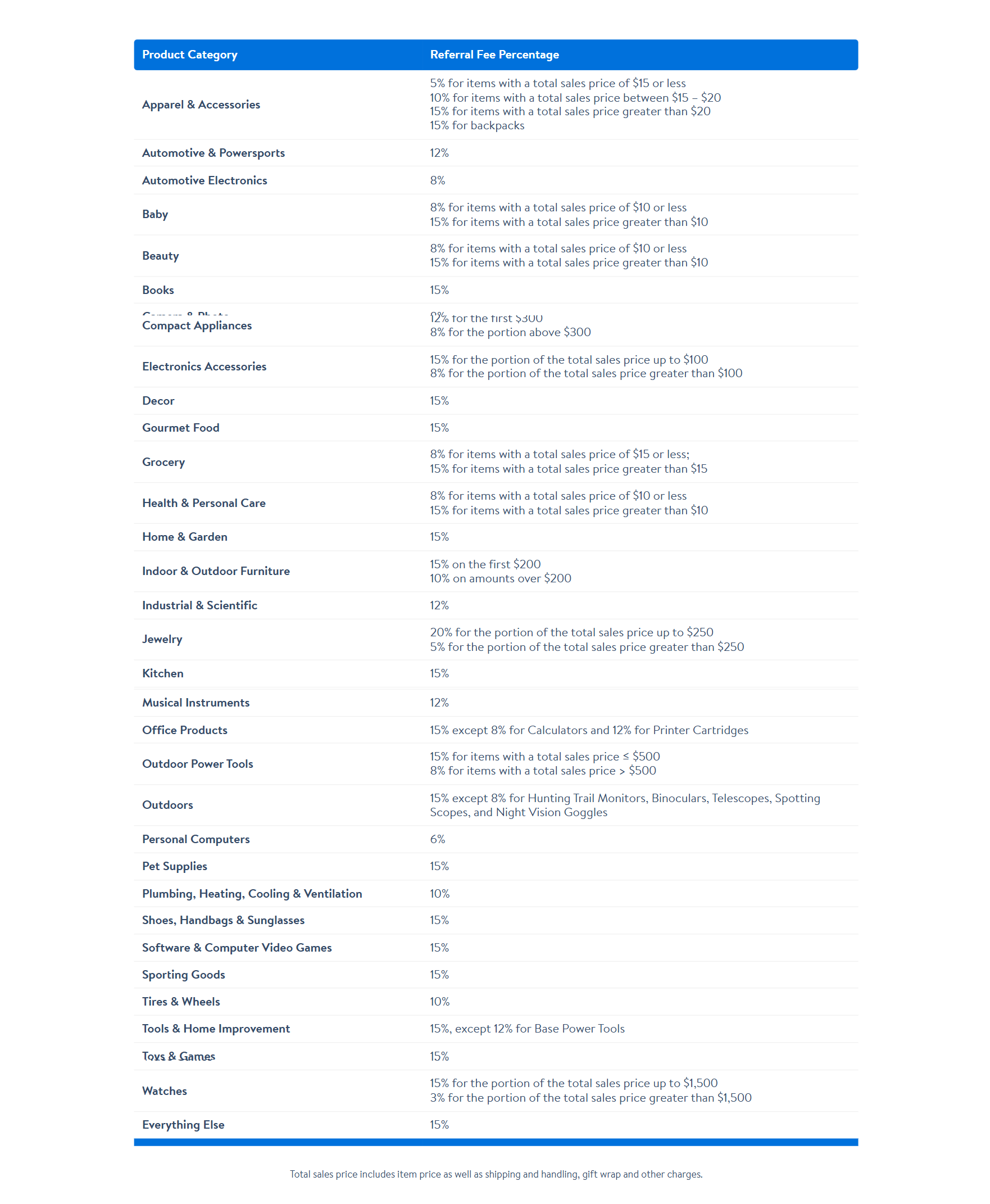

Walmart charges a referral fee that varies by product category, typically ranging from 5% to 15% of the item’s selling price. The commission is automatically deducted from the selling price once a sale is made.

Walmart Marketplace Referral Fees Breakdown

The primary expense for selling on Walmart Marketplace is the referral fee, which is determined by the product category. In most cases, the referral fee is around 15%, but it can be lower or higher for specific categories.

It’s crucial to review the category-specific rates to understand how they impact profitability. Below is a table showing Walmart referral fees for each category.

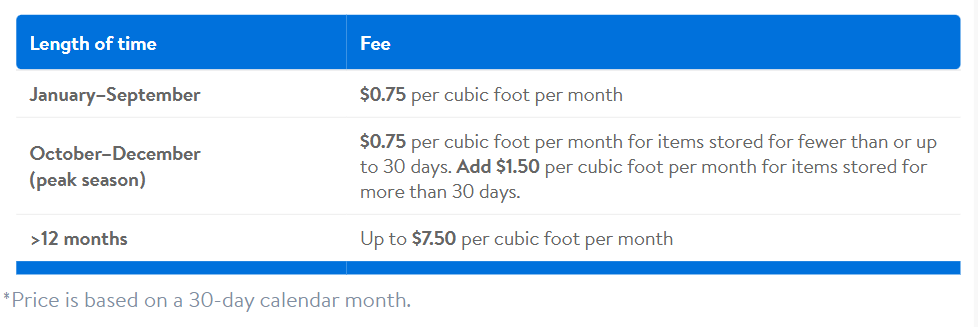

Understanding Walmart Storage Fees

Sellers using Walmart Fulfillment Services (WFS) incur storage costs based on the volume and storage duration of their products within Walmart fulfillment centers.

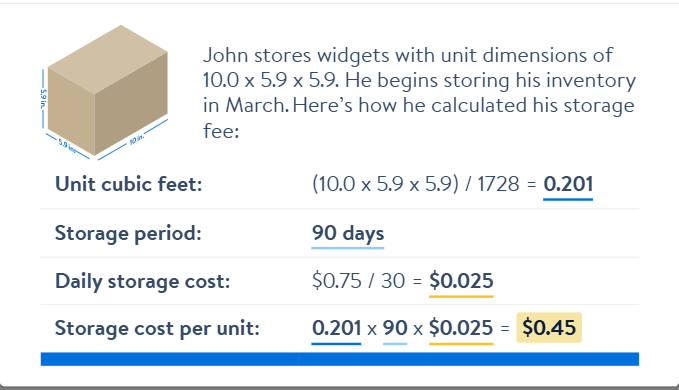

Storage fees are calculated based on the unit volume (length x width x height) divided by 1,728 to determine the cubic feet.

During the peak holiday season (October to December), an additional charge of $1.50 applies to items stored for over 30 days.

The above storage fees are for items stored for fewer than 365 days. If an item remains in storage for more than 365 days, the storage fee hikes up to $7.50 per cubic foot per month.

Example Storage Fee Calculation: Consider an item stored for 90 days; the storage fee will depend on the volume and duration, with additional peak season charges applied if applicable.

Walmart Fulfillment Service (WFS) Fees Explained

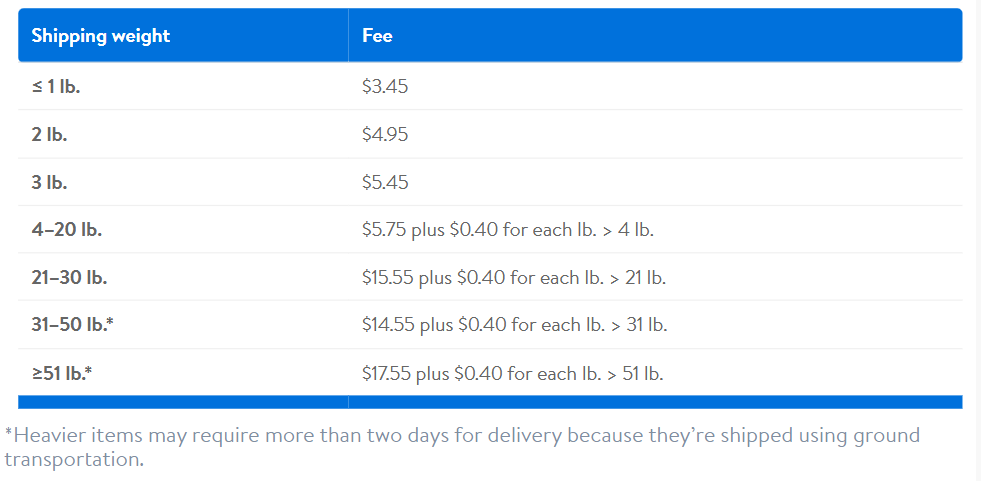

Walmart has two types of fulfillment fees based on the weight and dimensions of the object: Standard fulfillment fee and Big & Bulky fulfillment fee.

Standard Fulfillment Fee

A product qualifies as standard if it meets the following requirements:

- Weight does not exceed 150 lbs (including packaging)

- The longest side is 108 inches or less (including packaging)

- Longest side + girth (2x width + height) is 165 inches or less

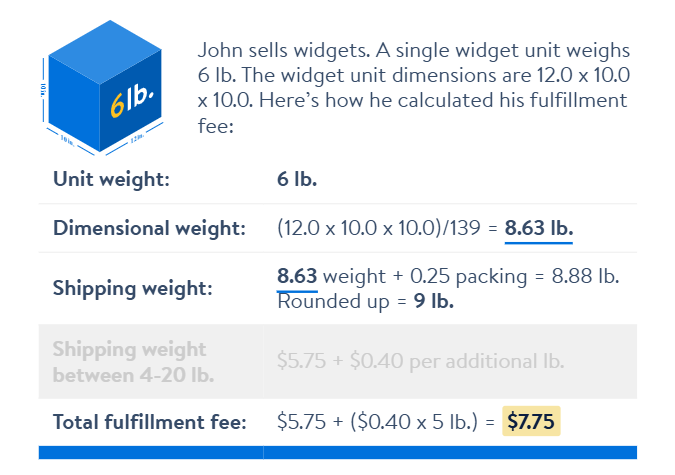

For items under 1 lb., the unit weight determines the fee. For heavier items (1-150 lbs.), the fulfillment cost is calculated using the greater of the unit or dimensional weight.

The dimensional weight is computed as: Length x Width x Height / 139

An additional 0.25 lbs. is added to account for packaging materials, and the shipping weight is rounded up to the nearest pound.

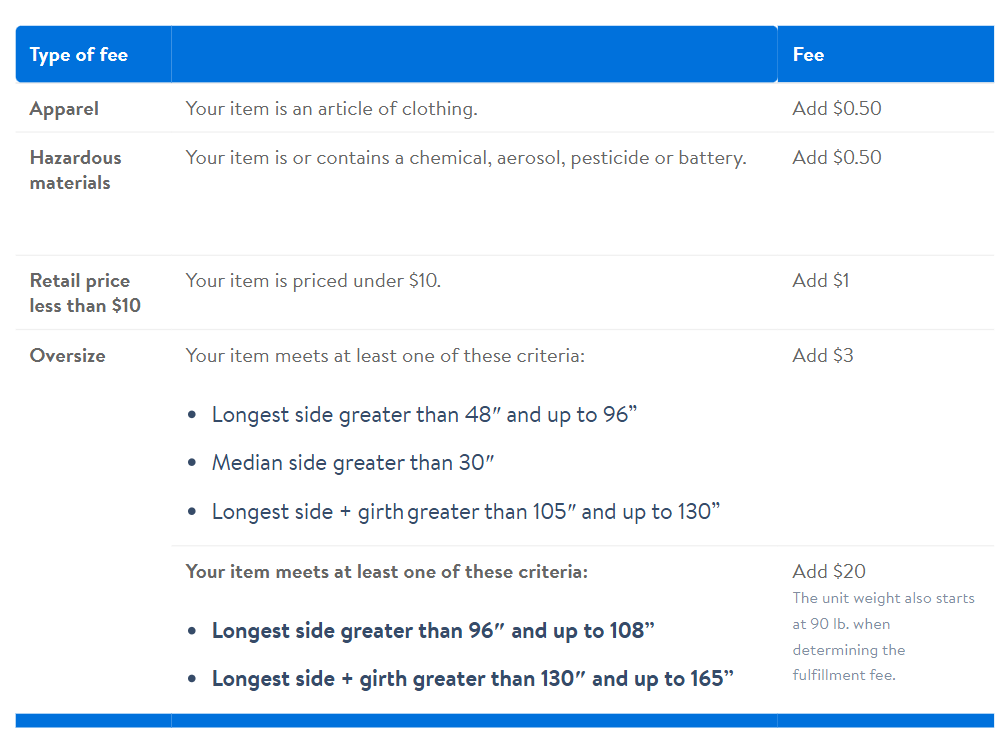

Additional Fulfillment Fees for Standard Items: There are certain product categories, such as clothing, hazardous materials, and oversized items, where additional fees are applicable.

Below is an example of how the WFS fee is calculated based on the dimensions and weight of the product.

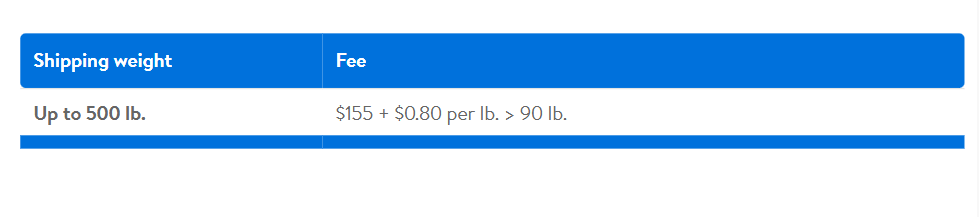

Big & Bulky Fulfillment Fee

Items that exceed standard dimensions are classified as big & bulky, incurring different fees. An item qualifies as big & bulky if it meets any of the following criteria:

- Weighs between 150 lbs and 500 lbs (including packaging)

- The longest side exceeds 108 inches, up to 120 inches

- Longest side + girth surpasses 165 inches

Shipping weight for big & bulky items is rounded to the nearest pound.

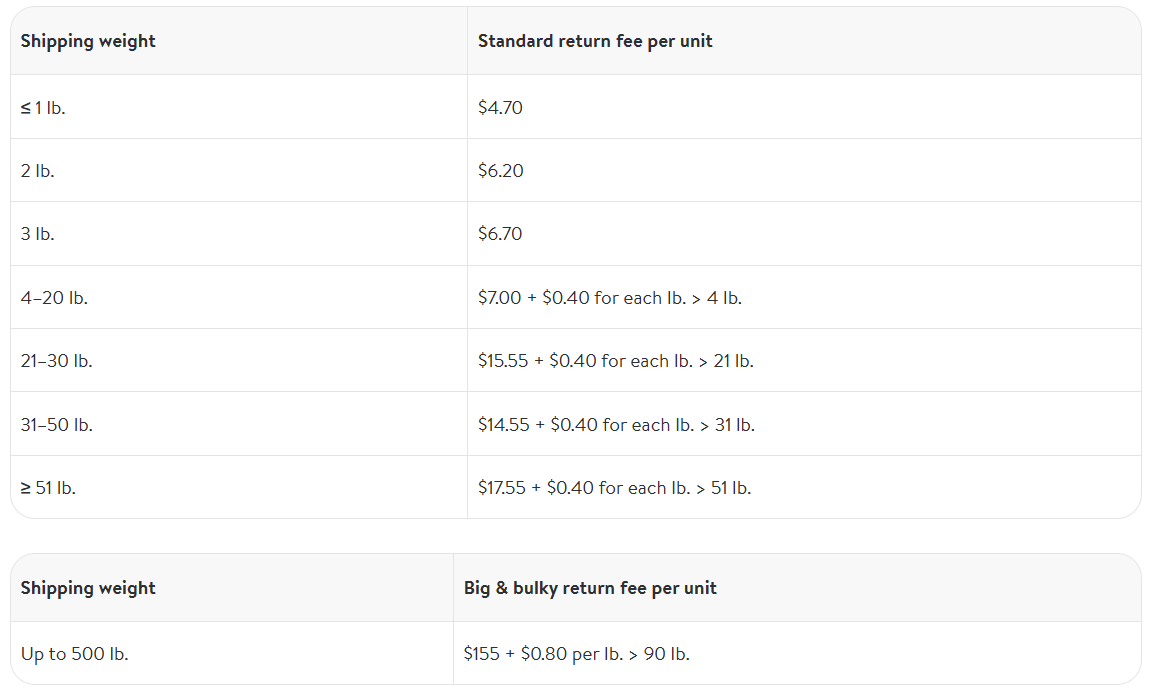

Walmart Return Processing Fee

Walmart covers the return shipping cost for issues that are Walmart’s fault, such as lost packages, delivery failures, damaged items, late arrivals, or incorrect items.

Sellers are responsible for return processing fees when the issue isn’t Walmart’s fault. These include reasons like wrong size, poor fit, missing parts, quality issues, not as described, incompatible items, buyer’s remorse, or the customer finding a lower price elsewhere. See the table below for a breakdown of the Walmart return fees.

Disposal & Removal Fee

Walmart offers disposal and removal services to its sellers, where the items can be disposed of or shipped back to the seller for a per-unit fee.

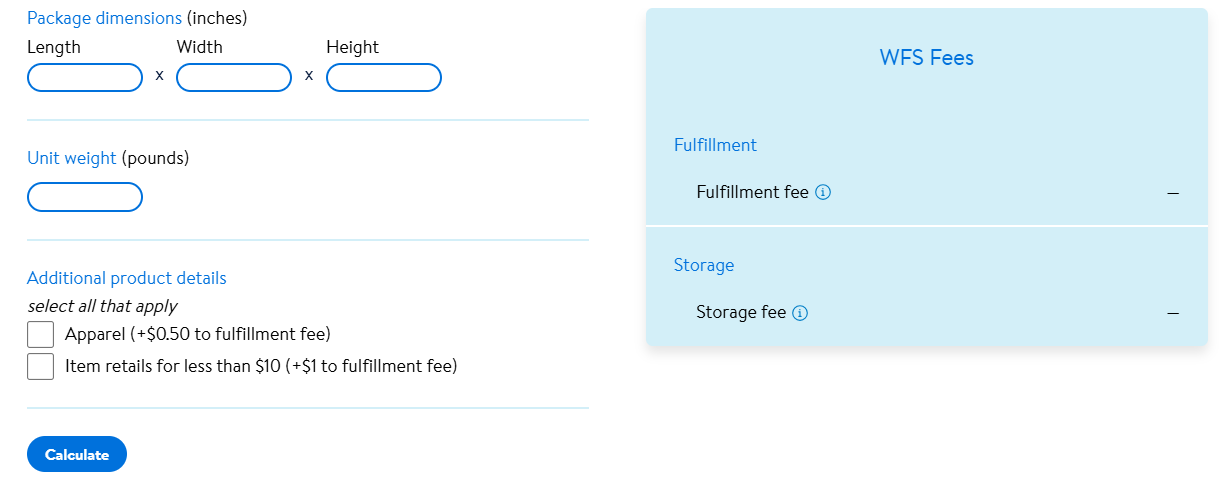

Estimating Storage and Fulfillment Costs

Sellers can use the WFS Cost Calculator to estimate their storage and fulfillment expenses by entering the product’s weight, dimensions, and other details to obtain an accurate fee breakdown.

Walmart Payment Schedule for Sellers

Walmart operates on a fixed payment schedule, typically processing payments every 14 days after account approval. Some sellers may qualify for weekly payment cycles, which can be verified in their retailer agreement or by reviewing their Payment History Reports.

Your joining date on Walmart Marketplace does not impact your payment frequency; it follows Walmart’s predetermined schedule. It’s recommended that Walmart’s settlement calendar be regularly checked to stay updated.

Also Read: 7 Walmart Account Management & Selling Strategies that Boost Sales

Setting Up Payment Accounts: Payoneer vs. Hyperwallet

To receive payments, sellers must set up an account with Payoneer or Hyperwallet.

Payoneer Setup:

- Requires valid ID, email, phone number, and business bank account

- The verification process typically takes three business days

Hyperwallet Setup:

- Allows linking of personal bank accounts, making it more flexible for independent sellers

- The faster and easier sign-up process

Choosing between these platforms depends on business needs and payment preferences.

Walmart Marketplace Sales Tax

As a certified or registered seller on Walmart Marketplace, you’re fully responsible for handling sales tax. Sales tax applies to Walmart’s items in all U.S. states and territories where it’s required.

Sellers on Walmart Marketplace must incorporate sales tax into their pricing strategy. Generally, the recommended approach is to include the sales tax directly within the product’s listed price. However, sellers also have the option to display the tax amount separately from the posted price. Ensuring transparency in the total cost for buyers is essential to avoid any confusion.

For further clarification regarding sales tax guidelines, Walmart offers a comprehensive guide about taxation on Walmart Marketplace Learn.

Comparing Walmart and Amazon Seller Fees

Amazon Fees

Selling on Amazon comes with a monthly fee. The following is the breakdown of the main types of Amazon fees:

- Seller Plans

- Individual plan: $0.99 per item sold.

- Professional plan: $39.99 monthly, with no per-item fee.

- Sales Fees

- Referral fees: 5%-45% of the selling price.

- Closing fee: $1.80 per media item.

- High-volume fee: $0.005 for listings over 100,000 items.

- Fulfillment Fees (FBA)

- Storage Fees

- $0.69 per cubic foot (January-September).

- $2.40 per cubic foot (October-December).

You can use the Amazon FBA Revenue Calculator to accurately estimate the various FBA fees applicable to your product.

Also Read: 10 Strategies for Long-Term Amazon FBA Success

Walmart Fees

Walmart doesn’t charge a monthly fee and other fees are usually a bit lower than Amazon:

- Monthly fees: No account fees or monthly fees; signing up is free.

- Referral fees: 5%-15% of the selling price, depending on the category.

- WFS Fees: While WFS fulfillment fees are typically lower, FBA’s more detailed weight class system can help you avoid paying for more weight than your products actually occupy.

- Storage Fees

- January – September: $0.75 per cubic foot

- October – December: Add $1.50 per cubic foot per month for items stored for more than 30 days

Walmart’s fees are lower, making it a budget-friendly option for sellers who want to save money.

Also Read: Selling on Walmart vs. Amazon – 2025 Guide

Conclusion

Understanding Walmart seller fees is crucial to making informed business decisions. With no monthly fees, competitive referral rates, and flexible fulfillment options, Walmart Marketplace presents a cost-effective opportunity for new sellers.

By leveraging available resources like the WFS cost calculator and regularly reviewing fee structures, sellers can optimize profitability and grow their online business successfully.

FAQ’s

Walmart takes a referral fee ranging from 6% to 15%, depending on the product category. The fee is deducted from the selling price when a sale is made.

Fulfillment fees are based on the item’s weight and dimensions. Standard and big & bulky categories have specific criteria that determine the costs.

No, Walmart does not charge any subscription fees; sellers only pay referral fees when a sale is made.

Some common misconceptions include hidden fees and high referral rates, but Walmart’s fee structure is straightforward and cost-effective.

Referral fees are calculated based on the discounted selling price, meaning the fee remains proportional to the final sale amount.