The world of e-commerce is booming, and for sellers, choosing the right platform is a decision that can significantly impact success. Among the many options available, Amazon and Walmart stand out as two of the most prominent names, each offering unique benefits and challenges. Both platforms have earned their reputation as giants in the industry.

Still, the question of where to sell often depends on various factors like market reach, seller policies, fees, and competition. If you’re debating selling on Walmart vs Amazon this guide will explore the nuances of each platform in greater detail to help you make an informed decision that aligns with your business goals.

Amazon vs Walmart: Market Share and Size

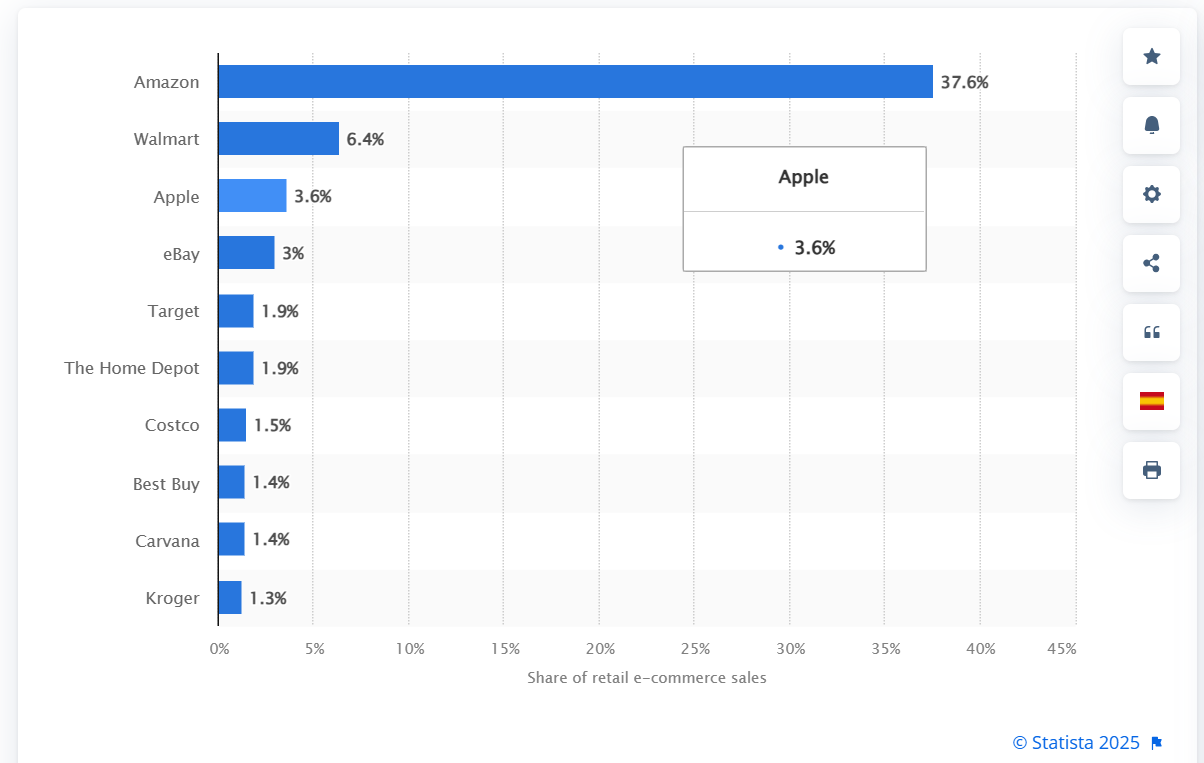

According to Statista, Amazon has the largest online retailer market share in the US, seizing almost 38% of the market. Walmart is the runner-up with the second-largest share of 6.4%. This number alone shows Amazon’s dominance in terms of popularity and credibility among online consumers.

Amazon’s supremacy in the market share is mirrored by its massive customer base with an average of 2.7 billion monthly visitors worldwide compared to Walmart’s 100 million visitors per month. So, you have a far greater chance of reaching a bigger audience on Amazon than Walmart–at least potentially.

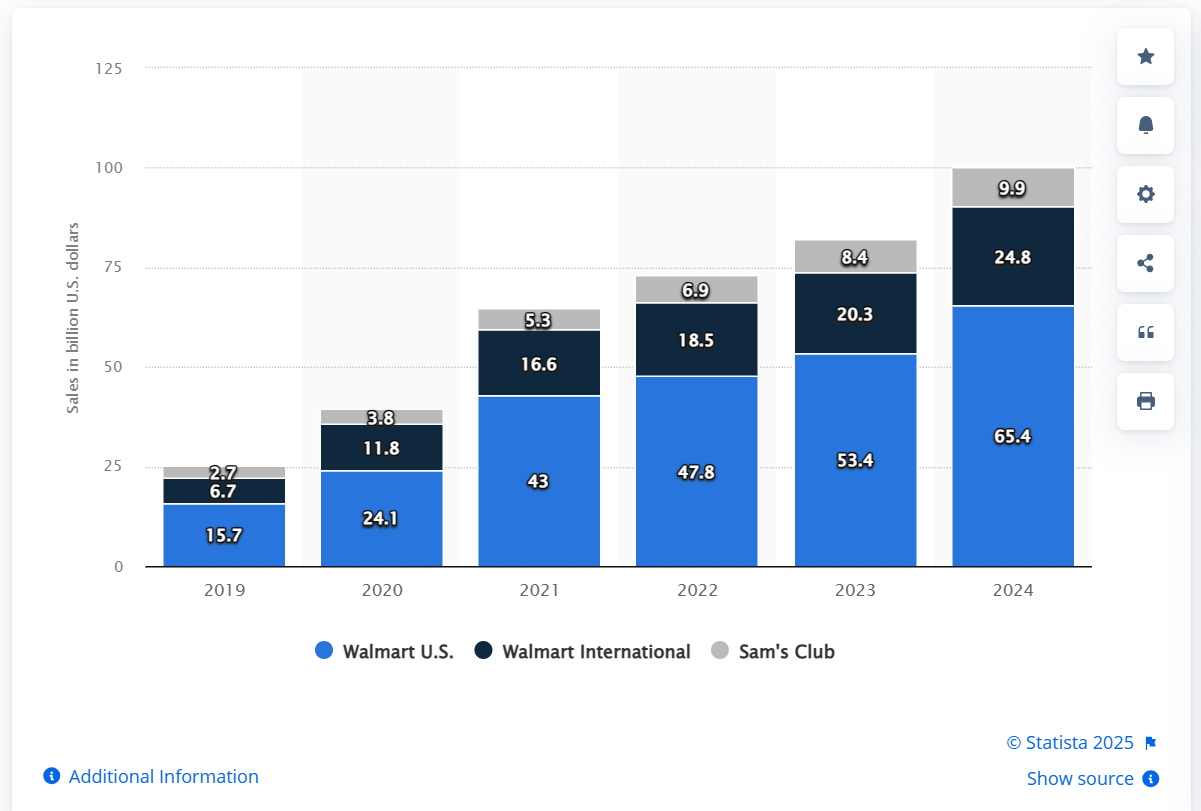

In 2024, Amazon achieved $491.65 billion in US e-commerce sales, reflecting a growth of approximately 10.54% compared to the previous year. Meanwhile, Walmart US recorded e-commerce sales of $65.4 billion, marking a 22% increase from 2023.

Amazon dwarfs Walmart in sheer sales revenue and customer base; however, this potential to reach a bigger audience comes at the expense of fierce competition. Amazon has over 9 million registered sellers among which almost 2 million actively sell on the platform compared to Walmart’s 0.15 million active sellers. Gaining visibility on Amazon is not a small feat as millions of sellers lock horns for customer attention.

Amazon vs. Walmart: Seller Competition

Amazon’s Competitive Landscape

Amazon boasts over 2 million active sellers and a customer base of more than 310 million users worldwide. This expansive reach provides significant sales potential but also intense competition.

To succeed on Amazon, sellers must:

- Optimize product listings with effective keywords.

- Strategically price products.

- Navigate the platform’s algorithm-driven search and Buy Box systems.

Amazon’s marketplace operates on a sophisticated algorithm that rewards well-optimized listings, competitive pricing, and excellent performance metrics. Sellers often need to invest in advertising campaigns and monitor their competitors closely to maintain a competitive edge.

While Amazon’s vast marketplace offers opportunities, sellers need sophisticated strategies to stay ahead. Constantly analyzing competitors and adapting to trends is essential. New sellers may find the competitive environment challenging but rewarding if approached with the right strategies.

Walmart’s Less Crowded Marketplace

Walmart’s marketplace, with around 150,000 active sellers, offers a less competitive environment. Although its customer base is smaller than Amazon’s, Walmart provides merchants with greater visibility and market share opportunities.

Walmart’s online sales reached $82.1 billion in 2023, accounting for 6.4% of the US e-commerce market. With its strong brick-and-mortar presence and growing online capabilities, Walmart is an attractive alternative for sellers looking to diversify their channels.

Walmart also offers a unique opportunity for sellers to reach cost-conscious customers who value everyday essentials and competitive prices. The platform’s smaller seller base translates to less competition, allowing new merchants to establish a foothold more easily than on Amazon.

Selling Fees: Walmart vs. Amazon

Amazon Fees

Selling on Amazon comes with a complex fee structure that includes:

- Seller Plans

- Individual plan: $0.99 per item sold.

- Professional plan: $39.99 monthly, with no per-item fee.

- Sales Fees

- Referral fees: 5%-45% of the selling price.

- Closing fee: $1.80 per media item.

- High-volume fee: $0.005 for listings over 100,000 items.

- Fulfillment Fees (FBA)

- Based on size, dimensions, and weight.

- Use Amazon’s Revenue Calculator to estimate costs.

- Storage Fees

- $0.69 per cubic foot (January-September).

- $2.40 per cubic foot (October-December).

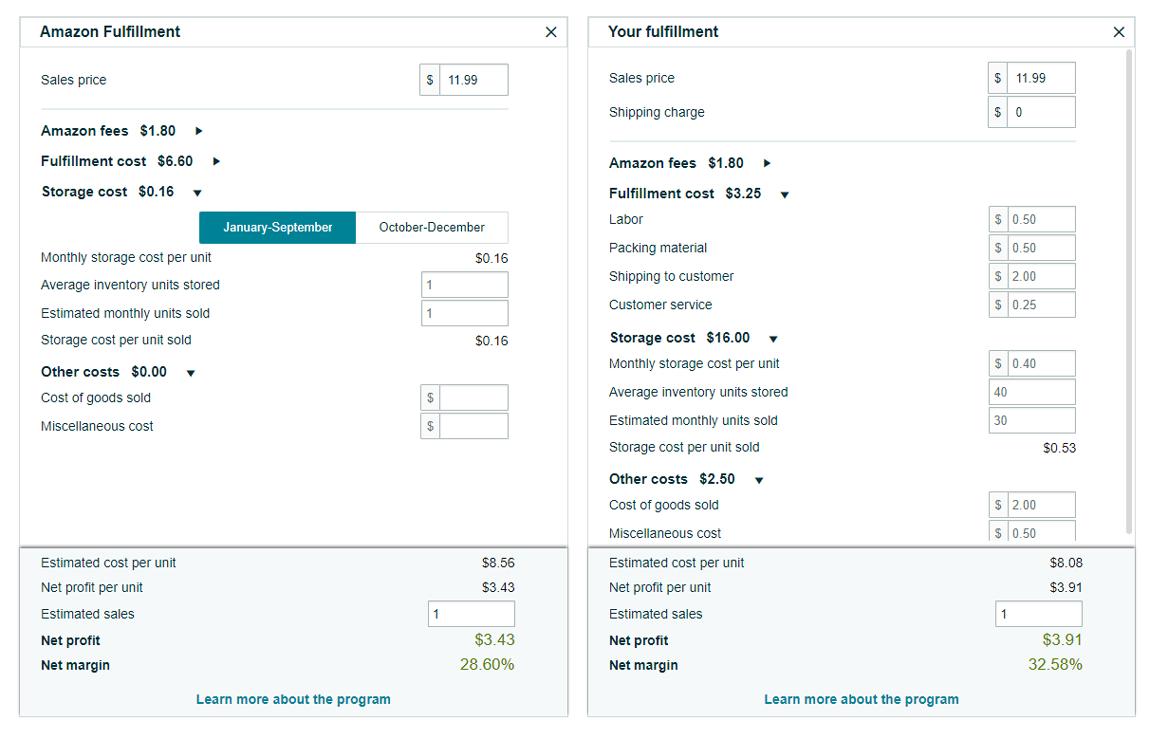

You can use the Amazon FBA revenue calculator to get an accurate estimate of the various FBA fees that apply to your product. Below is an example of a product sold through FBA vs FBM.

These fees can add up quickly, especially for high-volume sellers or those relying on FBA services. Understanding the cost structure is essential for maximizing profitability on Amazon.

Walmart Fees

Walmart’s fees are simpler and often lower:

- Monthly fees: No account fees or monthly fees; signing up is free.

- Referral fees: 5%-15% of the selling price, depending on the category.

- Fulfillment Fees: While WFS fulfillment fees are typically lower, FBA’s more detailed weight class system can help you avoid paying for more weight than your products actually occupy.

- Storage Fees

- January-September: $0.75 per cubic foot

- October-December: Add $1.50 per cubic foot per month for items stored for more than 30 days

For sellers on a tight budget, Walmart’s lower costs can be advantageous. However, Amazon’s massive customer base may lead to higher sales volumes. Walmart’s fee structure makes it a cost-effective platform for sellers prioritizing affordability.

Also Read: Understanding Walmart Seller Fees: A Comprehensive Guide for New Sellers

Seller Policies: Walmart vs. Amazon

Amazon Policies

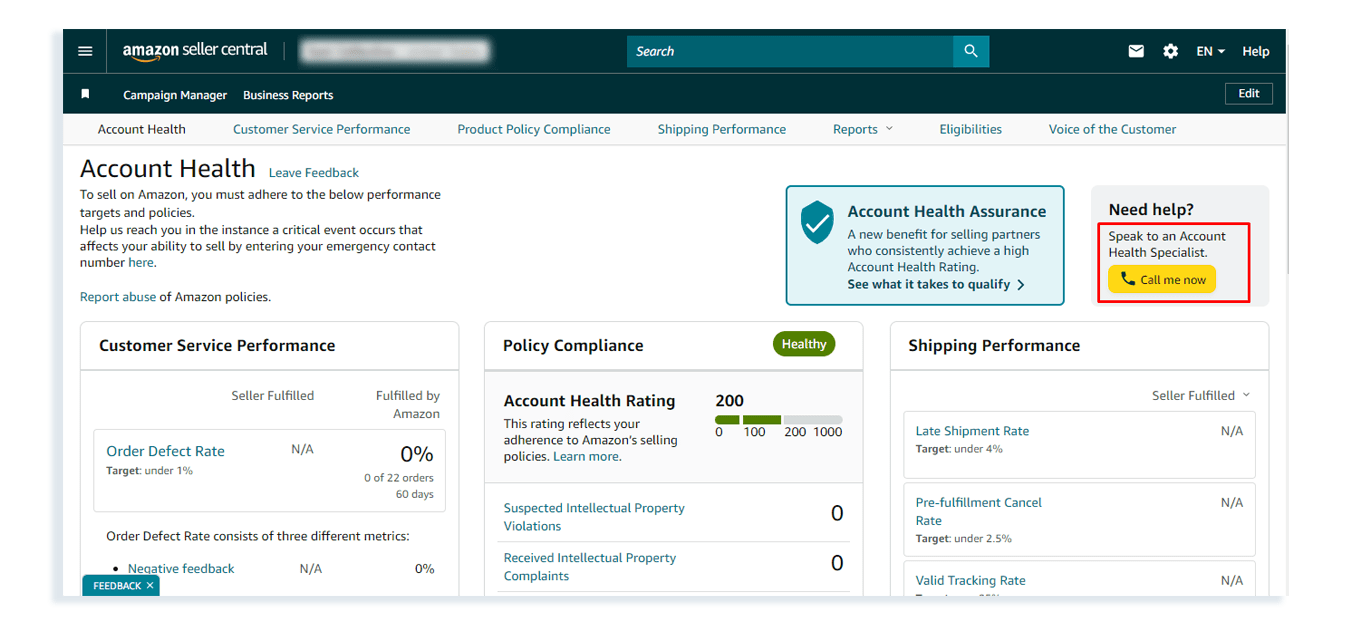

Amazon’s policies are stringent and comprehensive. Sellers must meet performance metrics, such as:

- Order defect rate < 1%

- Pre-fulfillment cancellation rate < 2.5%

- Late shipment rate < 4%

Failure to comply can result in account suspensions. However, Amazon offers tools and resources to help sellers succeed, such as advertising programs and performance analytics.

Amazon’s strict guidelines also extend to product descriptions, pricing practices, and intellectual property protections. Sellers must maintain high standards to avoid penalties, making the platform better suited to experienced merchants.

Also Read: How to Reduce Amazon ODR: Effective Strategies for Sellers

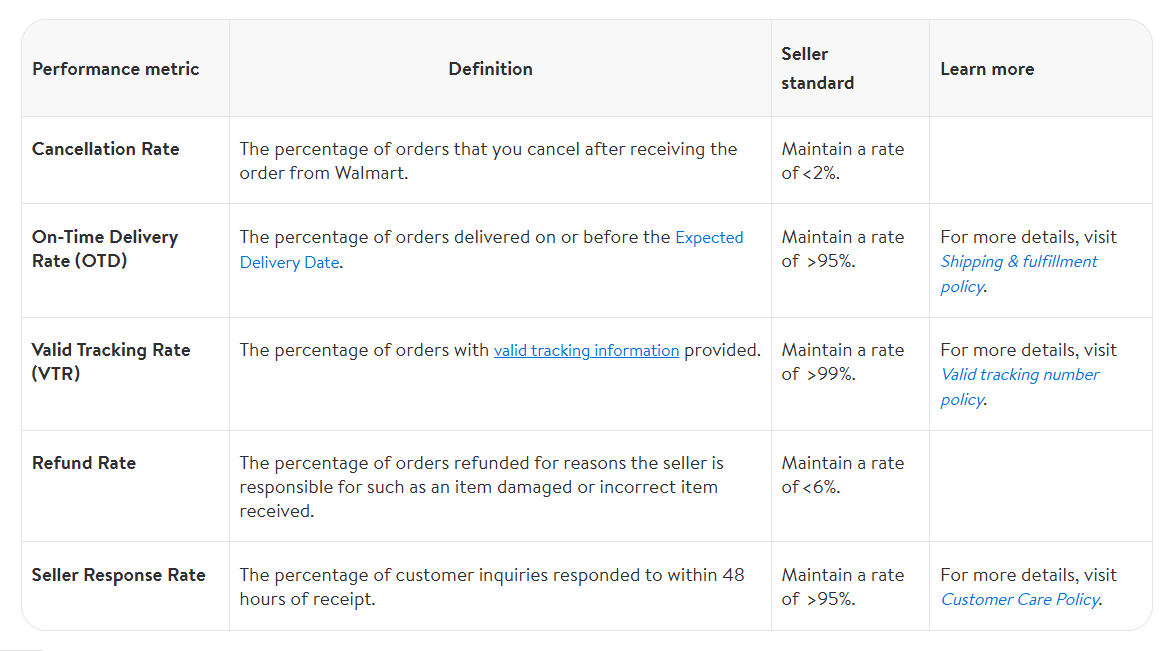

Walmart Policies

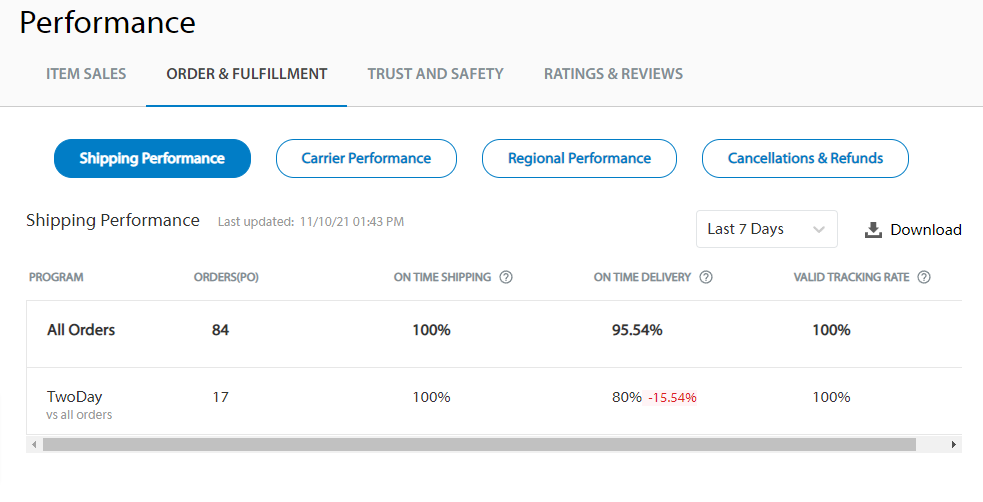

Walmart’s policies are more straightforward and lenient. Key performance metrics include:

- Order defect rate < 0-2%

- On-time delivery rate > 95%

- Valid tracking rate > 99%

Walmart often works with sellers to address issues before imposing penalties, making it a more approachable platform for newer or smaller businesses. The platform’s collaborative approach promotes a supportive environment for sellers.

Also Read: How to Avoid Walmart Account Suspension?

Product Types: Walmart vs. Amazon

Amazon’s Broad Product Range

Amazon allows sellers to list nearly anything legal, including:

- Electronics.

- Books.

- Clothing.

- Handcrafted items via Amazon Handmade.

While this diversity attracts a wide customer base, sellers must navigate strict rules for restricted items. Amazon’s expansive product categories make it a suitable choice for sellers offering niche or specialty items.

Walmart’s Value-Driven Catalog

Walmart’s marketplace focuses on cost-conscious customers, with 24 main departments covering:

- Groceries.

- Household essentials.

- Electronics.

Walmart prohibits certain items, such as used or vintage goods, alcohol, and tobacco. Sellers must adhere to specific guidelines for product attributes and classifications. The platform’s structured catalog helps customers find products easily, benefiting both buyers and sellers.

Shipping and Fulfillment: Walmart WFS vs. Amazon FBA

Amazon: Fulfilled By Amazon (FBA)

Amazon’s FBA service is designed to provide logistical simplicity. Sellers ship inventory to Amazon warehouses in bulk. Once an order is placed, Amazon handles the picking, packing, shipping, and even returns/exchanges. FBA is ideal for sellers who want to offer fast, reliable shipping, especially to Prime members.

Amazon’s extensive logistics network includes:

- 110+ fulfillment centers.

- 150+ package sortation facilities.

- 50+ Amazon Air regional hubs.

- A fleet of branded cargo planes and semi-trucks.

This infrastructure ensures reliable performance, even during peak seasons. However, FBA comes with fees that may not suit every seller, particularly established brands looking to control packaging or return policies. Amazon also offers free shipping for Prime members and orders over $35.

Also Read: 10 Strategies for Long-Term Amazon FBA Success

Walmart: WFS and Alternative Fulfillment Options

Walmart’s fulfillment system is growing rapidly. It offers two main options:

- Self-Fulfillment: Sellers manage inventory, shipping, and customer service independently. This option provides flexibility but requires significant effort.

- Walmart Fulfillment Services (WFS): Similar to FBA, WFS allows approved sellers to ship inventory to Walmart warehouses. Walmart then handles picking, packing, and shipping orders in Walmart-branded packaging. However, WFS is available only to established sellers and lacks the expansive network of FBA.

For sellers not using WFS, Walmart encourages third-party logistics (3PL) providers such as ShipBob, Rakuten, and ShipHero to meet two-day shipping standards. Walmart also launched Walmart+, a loyalty program similar to Amazon Prime, offering free same-day shipping for groceries and other perks.

Key Differences Between Amazon and Walmart Fulfillment:

- Amazon’s FBA is more robust, catering to a massive customer base.

- Walmart’s WFS is less accessible but provides opportunities for sellers to leverage Walmart’s growing e-commerce footprint.

- Walmart prohibits sellers from using Amazon Multi-Channel Fulfillment (MCF), reinforcing the need for alternative fulfillment options.

While Amazon’s fulfillment infrastructure is unmatched, Walmart’s growing options and third-party logistics support make it a viable alternative, especially for sellers looking to diversify.

Branding and Advertising

Amazon’s Competitive Advertising Landscape

Amazon’s marketplace is saturated, requiring sellers to invest heavily in:

- Branding: Maintain high ratings and meet performance standards.

- Advertising: Use pay-per-click (PPC) campaigns to target buyers.

Sellers must allocate significant resources to stand out on Amazon, making branding and advertising integral to success. The platform’s competitive environment drives innovation but demands constant effort.

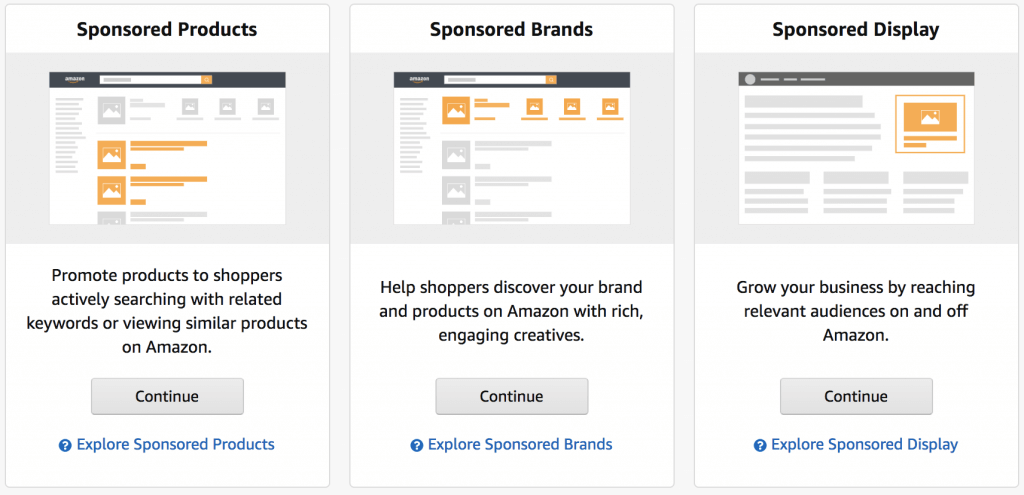

Amazon offers three different types of ads to target customers in various stages of their buying journey.

- Sponsored Product Ads: They appear in search results and detail pages and promote individual listings.

- Sponsored Brand Ads: These ads appear in shopping results, and feature a custom headline, brand logo, and multiple products. They are best suited for promoting your brand.

- Sponsored Display Ads: These ads feature creatives and reach audiences beyond the Amazon platform based on their shopping interests.

Also Read: Amazon Ad Types and their Benefits: A Complete Guide

Walmart’s Simplified Branding Opportunities

Walmart provides a less saturated advertising space, making it easier for sellers to stand out. With only 1.6% of sellers actively advertising, the cost-per-click (CPC) is lower than Amazon’s. Walmart also reduces intellectual property infringement risks with rigorous application requirements.

Walmart’s advertising landscape offers cost-effective opportunities for sellers to build brand recognition and attract customers without breaking the bank.

Walmart also offers different types of ads to improve visibility and attract customers in various stages of their journey.

- Walmart Sponsored Product Ads (Search In-Grid): These ads appear in the search results on Walmart’s website and app.

- Walmart Sponsored Product Ads (Carousels): These ads can appear in search, category, and product pages. They are not restricted by search terms and allow side-by-side comparison.

- Walmart Sponsored Brand Ads: Like Amazon Display ads, they include the brand logo, a custom headline, and up to four product listings with clickable links.

- Walmart Offsite and Onsite Display Ads: These ads can appear on the Walmart website and app and offsite on external sites. They can be managed through Walmart DSP and DSS for off-site and on-site monitoring.

Also Read: How to Start Advertising on Walmart: A Guide for SMBs

Amazon vs. Walmart: Keyword Targeting

Amazon and Walmart have different keyword targeting and ad spending strategies. Amazon offers different types of targeting methods such as keyword, product, and category targeting, whereas Walmart only offers keyword targeting. This difference has a significant impact on your advertising abilities on both platforms.

As a seller, your success on Amazon relies on using relevant attribute-driven keywords that consist of generic features of your product and not necessarily the brand name. 78% of Amazon buyers use unbranded searches, meaning they are not looking for specific brands.

On the other hand, Walmart sellers heavily rely on brand names for keyword targeting. This can make it more challenging for lesser-known brands to compete with larger, more established companies on the Walmart platform.

Final Takeaway

When comparing selling on Walmart vs. Amazon, it’s clear that both platforms offer unique advantages. Amazon dominates the e-commerce market with unmatched reach and advanced tools but requires sellers to navigate high competition and complex fees. Walmart, on the other hand, offers a less crowded marketplace, lower costs, and supportive policies, making it ideal for new or budget-conscious sellers.

For the best results, consider diversifying your business by selling on both platforms. With the right strategies, you can maximize your reach and profitability while leveraging the strengths of each marketplace.

Got More Questions?

Walmart is often better for new sellers due to lower competition and simpler policies. However, Amazon offers greater sales potential for those who can handle the competitive environment.

Walmart generally has lower fees, including no account fees and simpler referral fees. Amazon’s fees can be higher due to FBA costs and storage fees.

Amazon’s high competition can make it hard to stand out, while Walmart’s smaller customer base might limit sales. Both platforms require constant optimization and adherence to policies.

Walmart is more beginner-friendly due to lower competition and fees, but Amazon provides larger sales opportunities for experienced sellers.

Amazon’s FBA provides end-to-end logistics, while Walmart’s WFS is limited to approved sellers. Self-fulfillment is more common in the Walmart marketplace.

Amazon offers extensive PPC advertising tools, while Walmart’s less saturated ad space provides lower-cost opportunities for branding and promotions.

Yes, but diversifying across both platforms can help maximize sales potential and reduce reliance on a single marketplace.